Our choices define us. Every single day, we make hundreds of choices. From the shoes we are going to wear that day to what we are going to eat for lunch, each of these decisions has a ripple affect on our day, our week, and ultimately, our life. It is crucial that we make this choices consciously and with intent. Here are 5 lifestyle choices that Singaporeans are making that directly affect their financial health.

3 Lifestyle Choices Made by Singaporeans That Harm Their Financial Health

- Failing to Manage Debt

Many Singaporeans are prudent enough to monitor their cash flow but this does not always translate to them making smart financial choices. The rise of Buy Now Pay Later (BNPL) solutions such as Atome has made it easier for people to make purchases that they would not have considered had they been forced to make a single payment at the point of purchase.

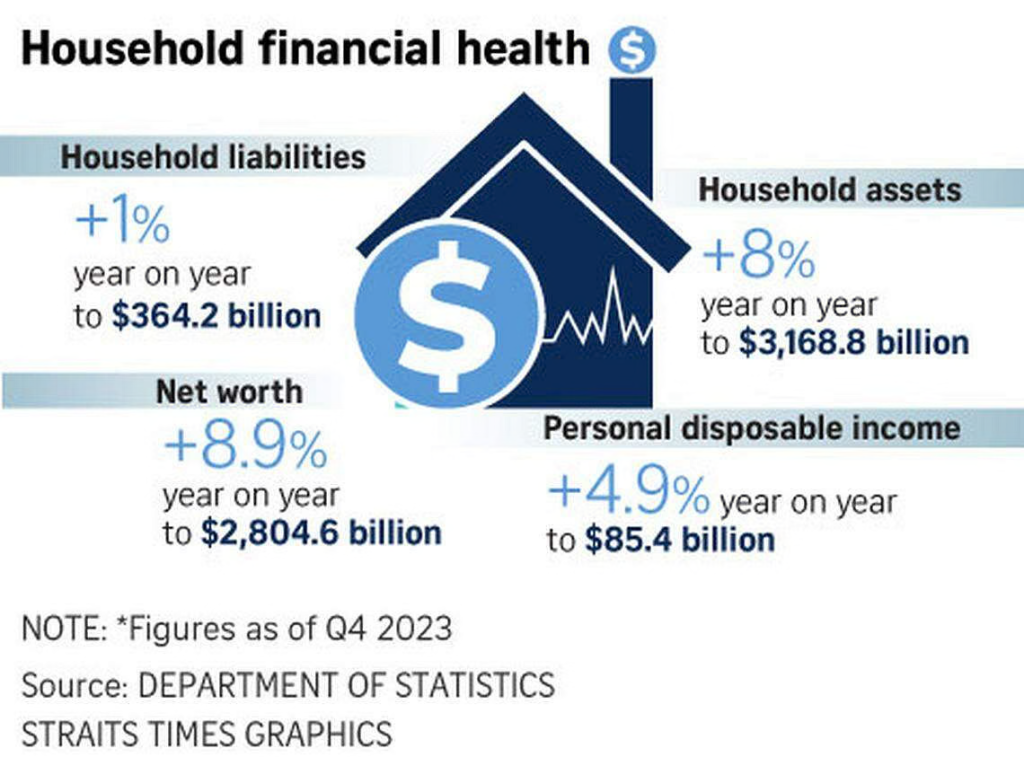

However, it is not just ill-advised Balenciaga bags that can affect your budget. The amount of debt that Singaporean households hold ballooned to $364.2 billion last year, with each household holding an average of $55,000 of debt at any given time. The vast majority of this debt comes from car and home loans. Since this is a common expense for many Singaporeans, it can be easy to ignore options such as refinancing and advanced budgeting to minimize the impact that these obligations have on your financial health.

2. Considering Non-liquid Assets a Part of Their Retirement Fund

Singaporeans are typically considered a wealthy bunch. After all, if we can afford to buy houses here, we can definitely afford to thrive here, right? For most Singaporeans, the answer to this question is not as straight forward. The cost of living crisis is well and truly underway and our solution to make ourselves feel like we are doing well is by looking at our net worth instead of our cash flow.

Have you ever heard a family member claim that selling your home and moving to JB is the best retirement plan they can think of? These thoughts are simply the desperate graspings of people that have failed to actually calculate their daily expenses, factor in inflation, prepare for medical emergencies, and adjust their budgets according to their change in lifestyle.

Even if you liquidate all your assets, that plan only works if you die on time. A client once remarked “if I cannot spend all my money while I’m alive, it’s okay but if I am still alive once my money runs out, how will I survive?”

3. Not Recognizing the Link Between Physical and Financial Health

Even the most savvy of us can sometimes go overboard with planning and preparing for our future. Singaporeans are known to be among the most hardworking employees in the world but this often comes with mental and physical challenges. The thought of securing a better future for our families can lead some to drive private hire cars for 12 hours in a day but can also cause us to forgo sleep, miss medical appointments, and ignore physical issues until it is too late for fear of hefty medical bills.

Research from TELUS Health found that more than a quarter of Singaporeans cut back on health-related expenditure as a direct result of financial stress. These decisions can have a direct impact on our health in the medium and long term, leading to even more expensive medical bills that cannot be avoided any longer.

How a Qualified Partner Can Help You Identify and Close Gaps in Your Financial Planning

These problems are not always obvious to us, especially since we can be biased towards our own finances. Thinking about retirement and medical calamities can be stressful and confusing but it is essential for anyone that wishes to create a stress-free future.

Take the first step to plan your expenses and secure your financial future now and book a free 45 review session with a qualified financial consultant today!

Leave a comment