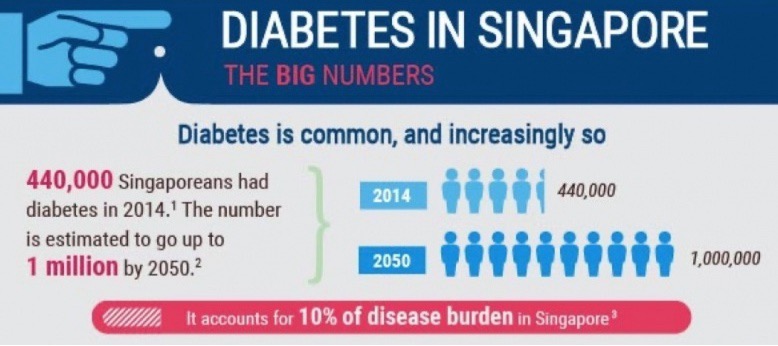

An ice-cold Starbucks Matcha Latte or a LiHo Wintermelon Milk Tea can be the perfect refresher for a hot day, but the health impacts of these little treats are already being felt by many Singaporeans. There are more than 440,000 Singaporeans with living with diabetes today and that number is expected to reach 1 million by 2050.

Why Diabetes Can Be a Financial Nightmare for Singapore Residents

In the near future, the regular cost of diabetes treatment is expected to reach $10,000 a year. This alone can be a challenge for many working-age Singaporeans. Patients under financial stress are less likely to save regularly and can be worried to invest due to perceived risks wrongly attributed to investments. Even securing insurance coverage can become a challenge without a financial consultant that understands the specific challenges that comes with a diabetes diagnosis. Here are the 3 most common problems that we have observed from our interactions with diabetes patients in Singapore.

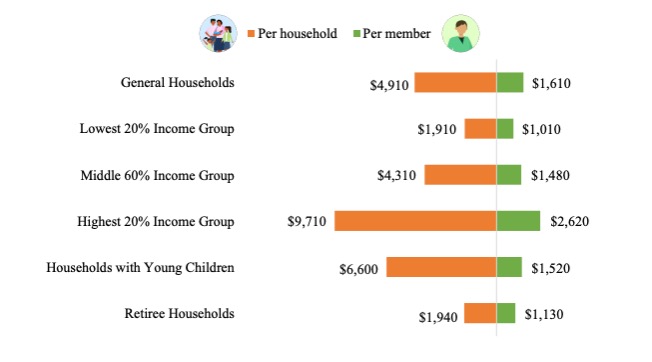

1. Underestimating How Much You Need for Retirement

Most people understand that they should put aside a portion of their income to plan for mishaps and prepare for retirements. However, poor planning and high expenses can make this difficult. The average Singaporean household would need a monthly passive income of over $4,000 to make ends meet. Putting aside the bare minimum sum that you can afford means that you will have to drastically change your lifestyle once you retire. Diabetes patients often factor in the cost of treatment and medication as they are today but fail to account for rising medical expenses and preparation for diabetes-related complications and illnesses.

2. Believing That Insurance Is No Longer an Option for You

People suffering with diabetes can sometimes be led astray by financial consultants that are either not bothered to create bespoke solutions for atypical clients or are unaware of how to build solutions for them. As diabetes and similar illnesses become more common in Singapore, insurers have stepped up to create highly specialised products that clients with a medical history can benefit from.

3. Not Taking Steps to Mitigate the Impact of the Disease on Your Life

Diabetes, like many other diseases, can be exacerbated by your lifestyle choices. Once you receive your diagnosis, it is important that you arm yourself with information on how you can manage the illness and prevent complications from arising. Make sure you take your doctor’s advice seriously and follow their recommendations carefully.

How Holistic Financial Planning Can Help You Create Wealth and Protect the Money That You Already Have

Most people understand the importance of holistic financial planning, but pushy salespeople and self-interested agents can make it difficult to find a consultant that is knowledgeable, professional, and empathetic. This is why you should always choose a consultant that is able to give you advice that is highly specific to you and can explain exactly why certain protections are important for you. Most of all, you should feel comfortable talking to your representative.

A good financial planner will understand the impact that diabetes has on your insurance options and the considerations that you have when you allocate spending. This will help you make the best decision for you and your family.

Take the first step to protect your financial future now and book a free 45 review session with a qualified financial consultant today!